Renters Insurance in and around Las Vegas

Las Vegas renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

Your belongings are important and so is keeping them safe. Doing what you can to keep it safe just makes sense! That’s why the most sensible step is getting renters insurance from State Farm. A State Farm renters insurance policy can protect your possessions, from your entertainment center to your sports equipment. Unsure how to choose a level of coverage? That's okay! David Habart is here to help you evaluate your risks and help pick the appropriate policy today.

Las Vegas renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Why Renters In Las Vegas Choose State Farm

Renting a home is the right decision for a lot of people, and so is getting insurance to protect your belongings. In general, your landlord's insurance may cover damage to the structure of your rented home, but that doesn't include what you own. Renters insurance helps safeguard your personal possessions in case of the unexpected.

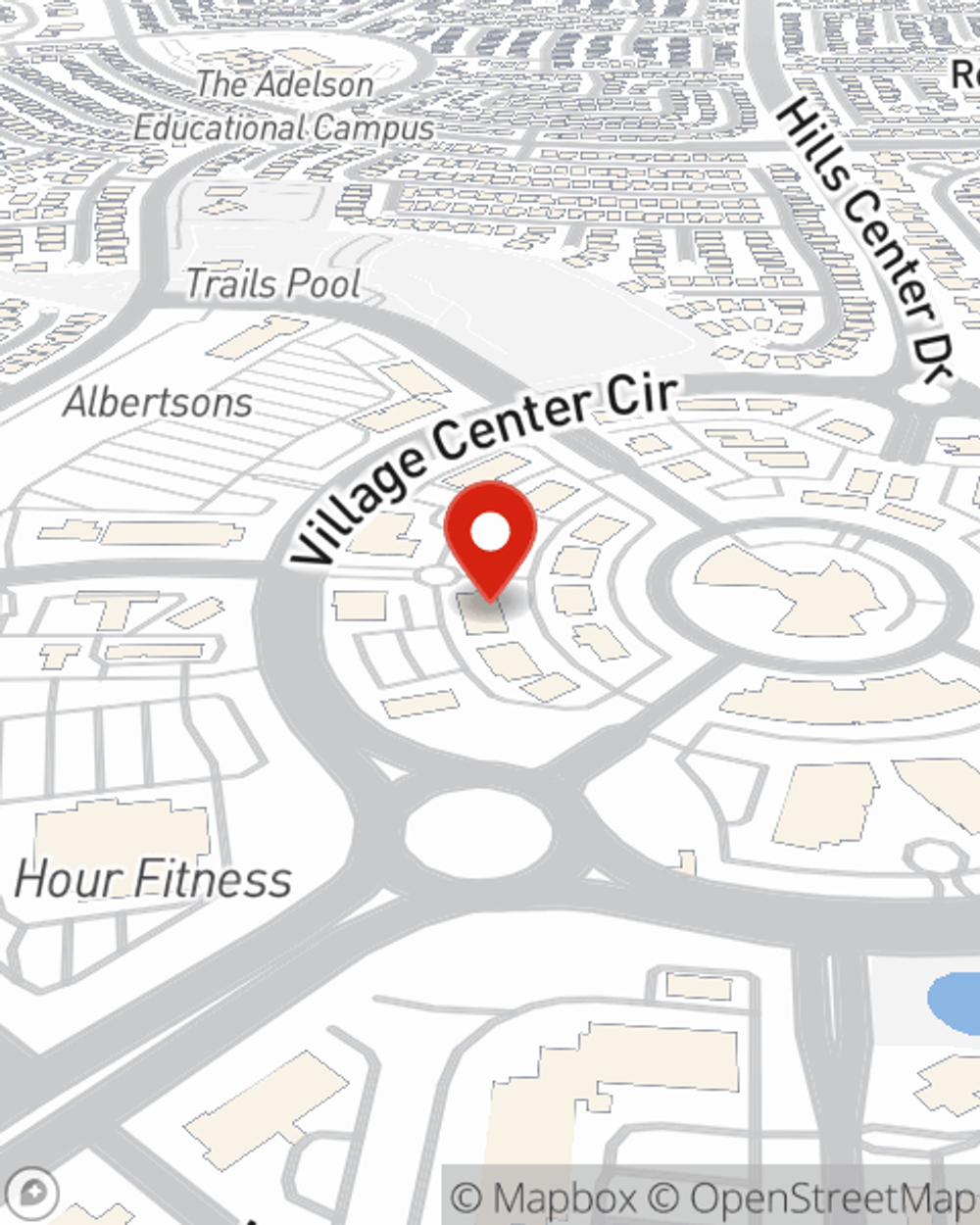

As one of the industry leaders for insurance, State Farm can offer you coverage for your renters insurance needs in Las Vegas. Reach out to agent David Habart's office to discover a renters insurance policy that works for you.

Have More Questions About Renters Insurance?

Call David at (702) 851-2400 or visit our FAQ page.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

David Habart

State Farm® Insurance AgentSimple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.